In today’s fast-evolving financial ecosystem, real-time data access is transforming how individuals approach credit. One of the biggest developments is the real-time update of your CIBIL score—a shift that directly empowers borrowers to take greater control of their financial futures. Whether you’re eyeing an instant personal loan, starting the gold loan process, or simply keeping your financial health in check, staying updated with your CIBIL score has always been crucial.

As India moves toward greater financial transparency and accessibility, platforms like Muthoot Finance not only offer convenient loan services but also provide free credit score checks to help you monitor your creditworthiness proactively.

What is a CIBIL Score and Why It Matters

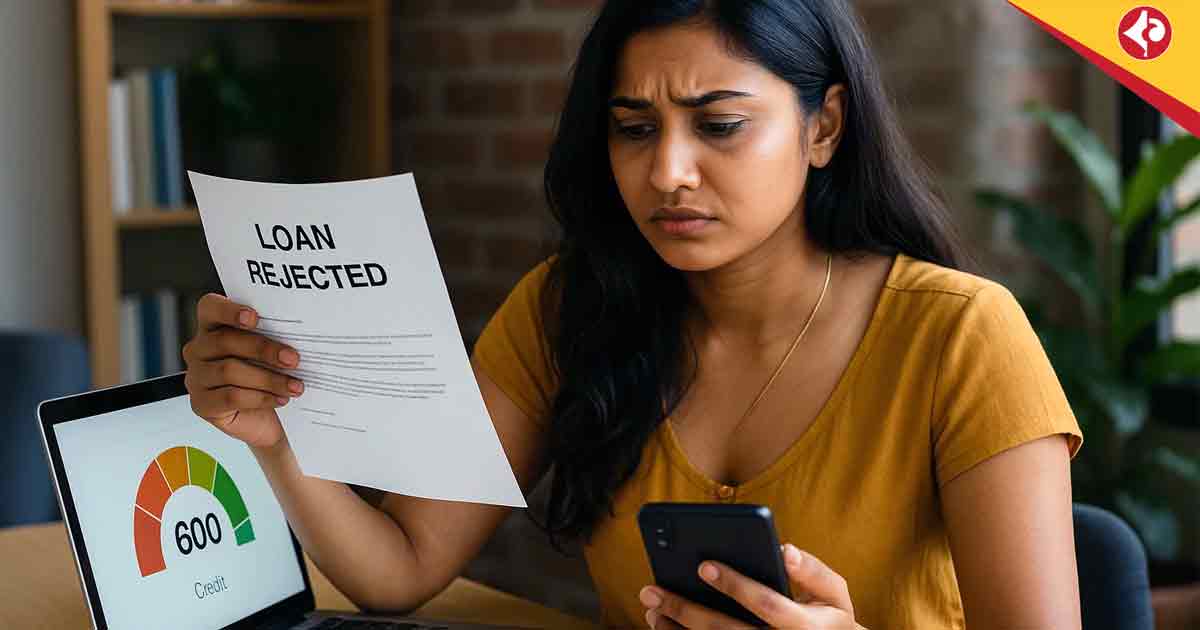

Your CIBIL score is a three-digit number ranging from 300 to 900 that reflects your credit health. It is calculated based on factors such as your credit history, repayment habits, loan mix, and credit utilization. A higher score not only improves your chances of loan approval but also gives you access to better financial products and interest rates.

Here’s a quick breakdown of what various score ranges mean:

CIBIL Score | Category | Implication |

Below 300 | No Credit History | Begin building credit with responsible usage |

300–550 | Poor Credit Score | High-risk borrower, needs significant improvement |

551–700 | Fair Credit Score | Moderate history; some scope for improvement |

701–750 | Good Credit Score | Reliable borrower; eligible for better terms |

Above 750 | Excellent Credit Score | Strong credit discipline; access to premium loan and card options |

What Real-Time CIBIL Score Updates Mean for You

Until recently, CIBIL scores were updated only periodically—usually weeks after your financial activity. This lag meant that even after paying off debts or improving credit behavior, you’d have to wait to see a positive reflection in your score.

Now, thanks to real-time or near-instant updates, your score adjusts quickly based on your financial actions. This change offers meaningful benefits:

✅ Faster Loan Approvals

If you’re applying for instant personal loan, your most recent activity—such as clearing overdue bills—will be visible to lenders, boosting your approval chances.

✅ Improved Credit Visibility

Real-time updates allow you to monitor your credit standing more accurately. You don’t have to guess when your payments or changes in utilization will impact your score.

✅ Stronger Negotiation Power

Whether you’re requesting a higher credit limit or a better rate on your next loan, a recently improved CIBIL score gives you more leverage with lenders.

Impact on Gold Loan and Personal Loan Borrowers

While gold loans are secured and may not always require a CIBIL score check, having a strong score still helps build trust with lenders and can result in better loan conditions, especially if you’re exploring flexible repayment plans or high-value loans.

Here’s how real-time CIBIL updates impact both:

Loan Type | How Real-Time CIBIL Helps |

Gold Loan | Not always mandatory, but a good score can help in negotiating better interest terms |

Personal Loan | Critical for fast-track approvals and better interest rates |

Even during the gold loan process, even if not a mandatory criterion, a higher CIBIL score signals to the lender that you’re financially responsible, especially helpful if you’re applying for a top-up or second loan.

How to Improve Your CIBIL Score—and See Results Sooner

Thanks to real-time updates, good financial behavior reflects faster in your score. Here’s how to boost your score efficiently:

- Pay on time: Always pay EMIs, credit card bills, and utility dues on or before the due date.

- Keep credit utilization low: Ideally, use less than 30% of your credit card limit.

- Limit loan applications: Too many hard inquiries can pull your score down.

- Diversify credit types: Maintain a healthy mix of secured (like home or gold loan) and unsecured loans (like personal loans).

- Check reports regularly: Use platforms like Muthoot Finance’s free credit score tool to track changes and detect errors early.

- Clear old debts: Settle pending dues and remove red flags from your credit history.

Example: Real-Time Scores in Action

Take the case of Anita, a 32-year-old IT professional from Patna. Her CIBIL score hovered around 650, limiting her loan options. Over six months, she:

- Paid EMIs on time

- Reduced her credit card utilization from 70% to 25%

- Monitored her score using Muthoot Finance’s free credit score check tool

Thanks to real-time CIBIL updates, these positive behaviors reflected quickly. Within a year, her score rose to 790, helping her qualify for a home loan at a significantly lower interest rate—saving her lakhs in the long term.

Free Credit Score Checks: A Smart Habit

Keeping track of your credit score shouldn’t feel like a chore. Known and trusted institutions like Muthoot Finance offer free tools that let you check your credit score without affecting it. Over time, regular checks help you identify trends, spot inconsistencies, and plan—whether you’re considering a new credit card, a gold loan, or a major financial commitment.

Conclusion: A Smarter Financial Future Starts Now

The real-time update of your CIBIL score is a shift toward greater financial empowerment. Whether you’re planning to secure a personal loan, starting the gold loan process, or simply trying to stay financially fit, this development gives you the visibility and flexibility you need to make timely, informed decisions.

Muthoot Finance, known for its trusted loan services and financial tools, enables you to monitor your credit score for free, ensuring you’re always one step ahead. In a world where every financial move counts, staying updated with your credit score is the simplest—and smartest—way to shape a better financial future.